With the recent surge in gold prices, investors are undoubtedly eyeing this lustrous metal once again. Regularly, gold serves as a safe haven during volatile financial periods. But in the current favorable market conditions, gold assets are showing strength not just as a fallback, but as a potential wealth builder.

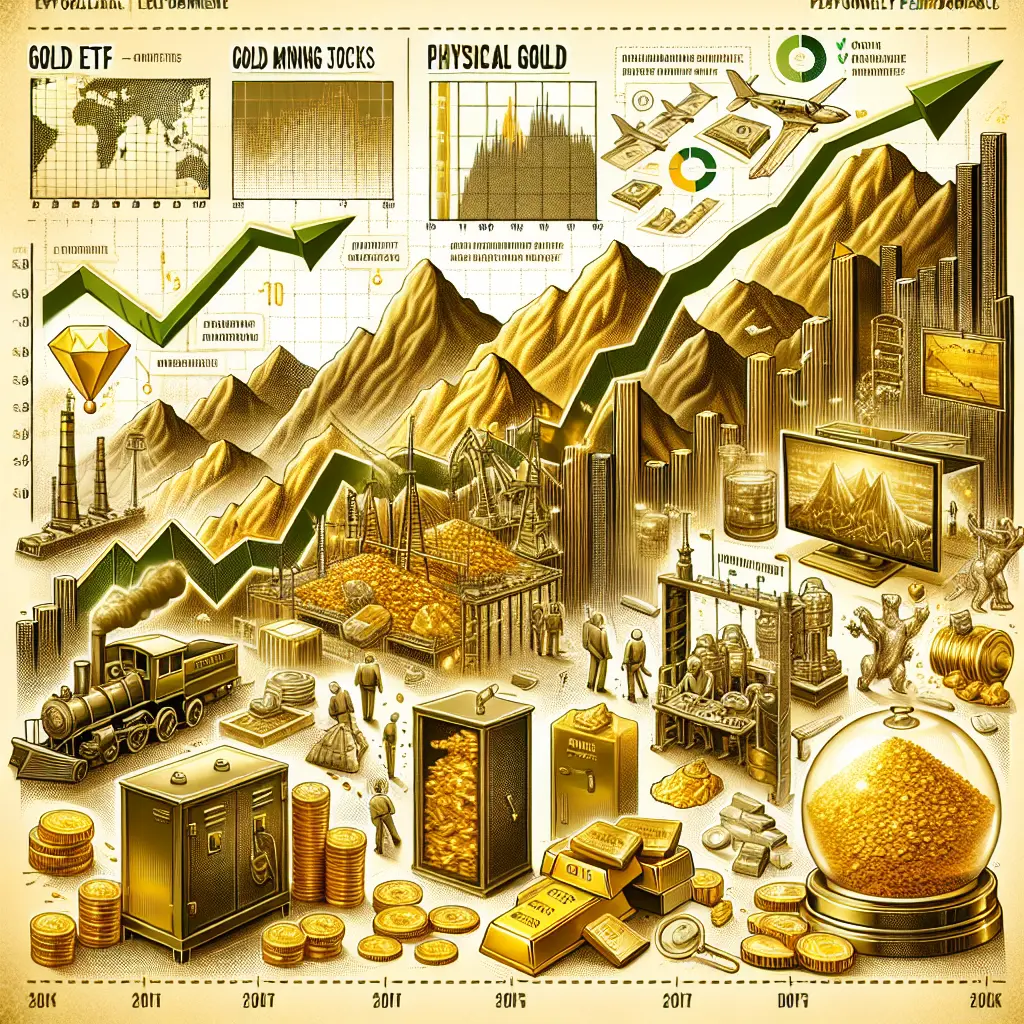

For those interested in investing in gold, a well-diversified portfolio is recommended. This can include gold exchange-traded funds (ETFs), gold mining stock, or physical gold itself.

Gold ETFs allow investors to have a stake in gold’s rising value without the need to store physical assets. They’re a practical way to gain exposure to gold prices, often closely matching its performance.

Investing in gold mining companies can offer higher potential gains, but these come with increased risk as success hinges on the companyâs operational capability.

Physical gold, in the form of bars or coins, offers direct ownership and control. However, it requires secure storage, often involving additional expenses.

As always, careful research and consideration of personal financial capabilities is important before any investment. Read More

Leave a Reply