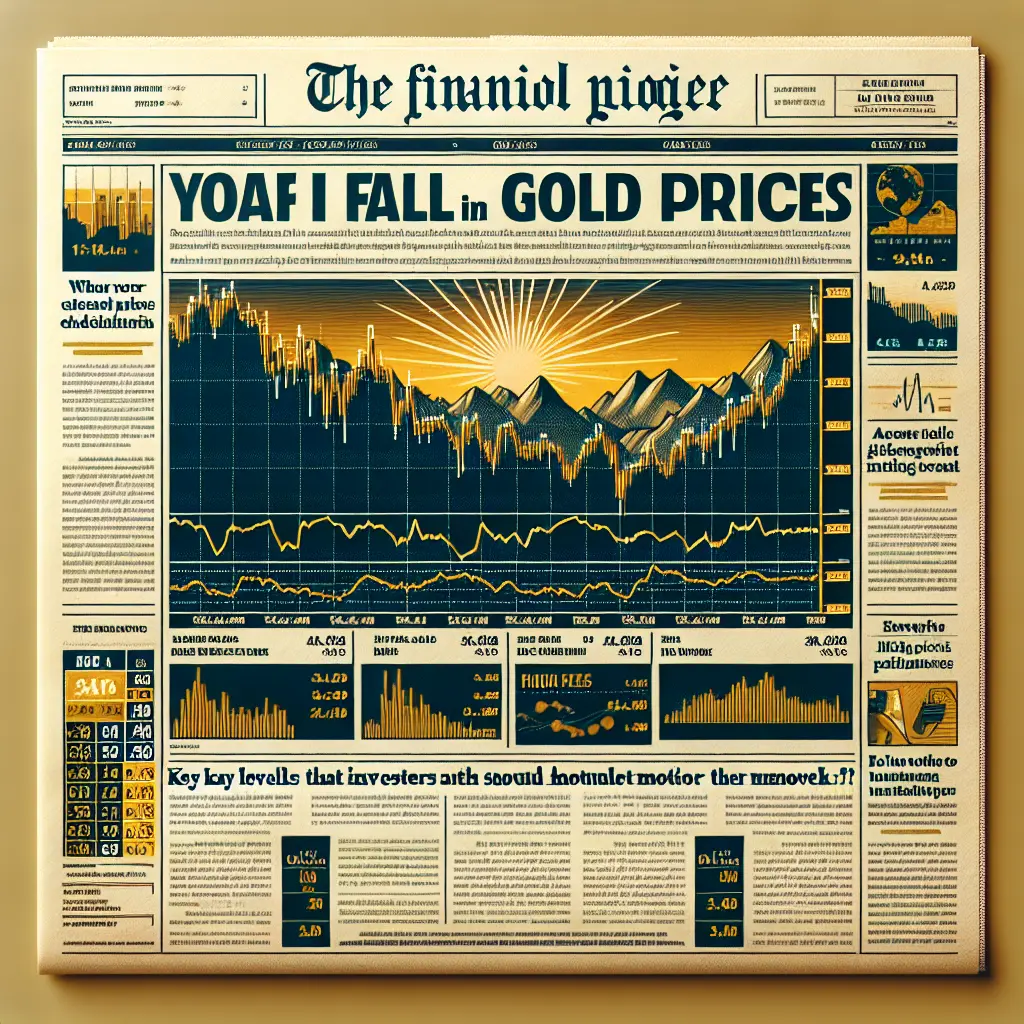

Gold prices witnessed a remarkable decline last week. The golden metal’s glitter seems to have faded due to significant factors impacting the global market. The primary reasons associated with this decrease include the strengthening of the US dollar, increased bond yields, and the anticipation of global economic recovery.

The US Dollar Index, which measures the greenback’s standing against a pool of other currencies, observed a rise, thereby making the dollar-denominated gold more expensive for holders of other currencies and consequently pushing down the gold prices.

Added to this, elevated bond yields offer investors attractive alternative investment, further discouraging the appeal of gold. Also, the global economic outlook’s improvement has driven investors to riskier assets and away from traditional safe havens such as gold.

Moving into next week, key levels to watch include the current support level at $1600 an ounce. If prices break below this level, we could potentially see further downward momentum. Conversely, the key resistance level stands at $1750 an ounce. A jump above this level could signify a possible upward reversal in the price of gold.

In conclusion, as the market gears up for another week, investors are advised to keep an eye on the outlined crucial levels.

Leave a Reply