Category: Economics

-

Silver Prices Predicted to Soar as Gold Gets Re-monetized, Says Expert

As gold’s value sees a revival and returns to being a reputable form of currency, precious metals expert Florian Grummes of Midas Touch Consulting foresees a significant increase in silver prices, even speculating it might hit the $50 mark by summer. Analyses suggest this stems from the global economic shift influenced by the re-monetization of…

-

Silver Price Today: Significant Increase on April 16 – FXStreet

In a surge reflective of investor confidence, the price of silver ascended remarkably on the 16th of April. The rise in silver prices is viewed by economic gurus as a symbol of sustained economic stability and a beacon of positive market growth. This upward trajectory in silver prices is predicted to continue, bolstered by strong…

-

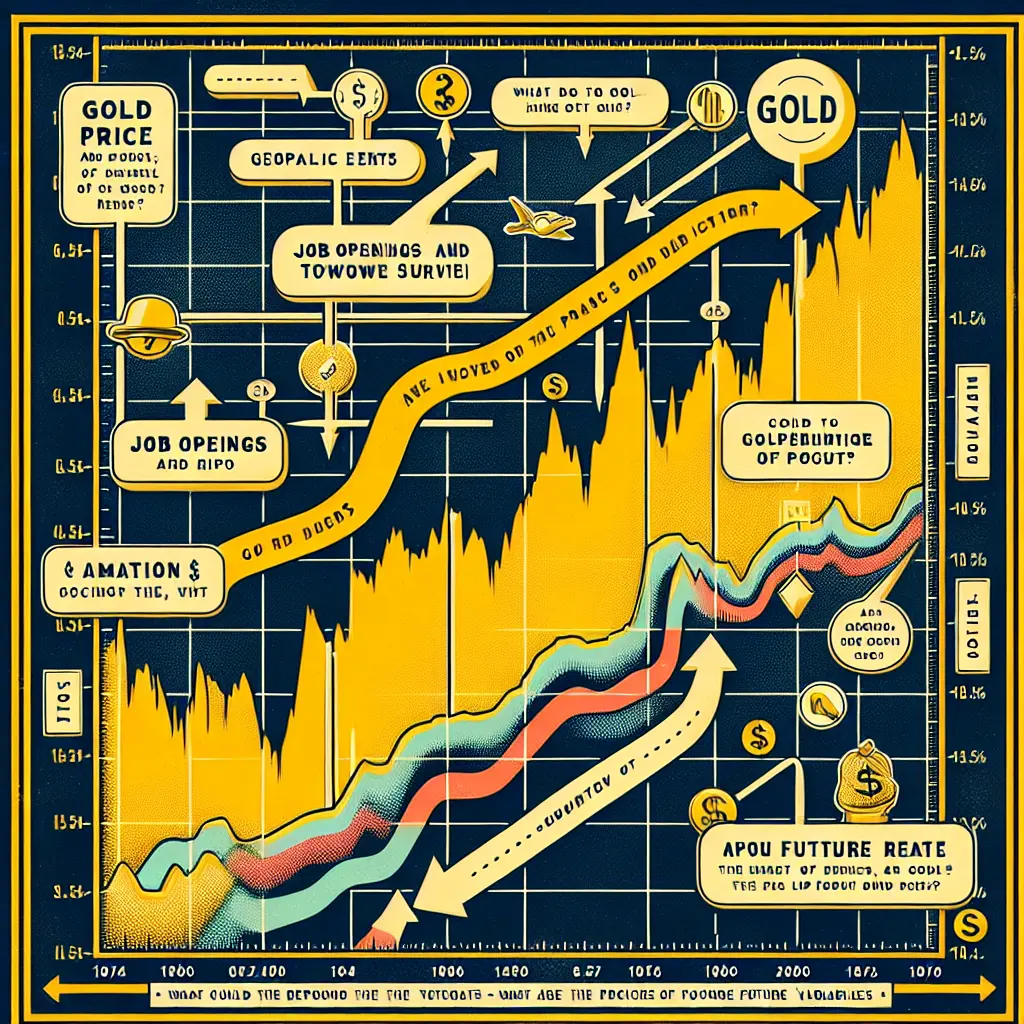

Gold Price Forecast: Robust Standing of XAU/USD amid Upcoming US NFP Data Release – FXStreet

As we head into the first week of April, all eyes are on the US Non-Farm Payroll (NFP) data which could potentially spring a surprise movement in the global economy, particularly in the gold market. XAU/USD has managed to hold its ground firm, hovering impressively above the $3,100 mark. Economists and traders alike are keenly…

-

Gold Prices Surge Following Trump’s Tariff Reveal – A Market Upheaval

Gold prices continue to escalate as Donald Trump announces plans to implement fresh tariffs, creating a domain of speculation and uncertainty across global markets. The precious metal, traditionally perceived as a safe haven during times of economic turmoil, has seen a significant uptick following the tariff-related news disclosed by the former President. Trump’s proposed tariffs…

-

Gold Price High Challenges Market Resistances: A Bearish Reversal Possible?

In an unexpected turn of events, the price of gold has reached an all-time record, challenging all existing market resistances. However, as the shiny metal basks in its glory, a bearish reversal lurks in the shadows, ready to potentially rewrite the market narrative. Experts warn investors to tread with caution, as this might be an…

-

An Exploration into the Record Surge in Gold Prices – Understanding Why Gold Prices Are at an All-Time High

In the current economic climate, the prices of gold have been surging to record highs. There are several factors contributing to this surge. One of the primary driving forces is the increasing uncertainty in global markets. As investors look for safe havens for their investments, gold has become a popular choice. In addition, the ongoing…

-

Gold rate forecast for 2025 revised by Economic Times’ experts and analysts

The experts and analysts of the Economic Times have revised their forecasts for the gold price in 2025 owing to factors such as global economic dynamics, geopolitical conditions, and inflation trends. They have predicted a surge in the gold rates attributing it to increasing global uncertainties and inflationary pressures. Investors are advised to keep an…

-

April’s Gold Price Forecast Points to Further Upsides: Miners & Silver in Focus

As we approach April, gold prices have been indicating a promising uptrend, providing a bullish landscape for investors. These economic predictions signal a continued rise – even hitting new highs for the year. The buoyancy of gold doesn’t exist in a vacuum. There are key factors at play influencing this golden age of trading. nnPrecious…

-

Exploring Reasons Behind the Sharp Rise in Gold Prices – Econofact

In recent times, the price of gold has seen an extraordinary surge. A multitude of factors contribute to this sharp rise. A key factor is the widespread economic uncertainty fueled by events such as the ongoing global pandemic and geopolitical tensions. As traditional fiat currencies face potential devaluation, the intrinsic value of gold becomes more…

-

Gold Price Dip Sparks Interest in US Inflation Print – A Shift in Focus

In a sudden twist of events, Gold’s price took a dip today, sparking a surge of interest in the US inflation print. The price decrease diverted attention to the state of US inflation, ushering in a new emphasis on its significance in driving global financial dynamics. Despite the drop, Gold remains a strong asset in…

-

Why Silver is the New Gold: Unleashing the Power of Silver in Today’s Economy

In an evolving economy, the spotlight often shines on a record-breaking gold price. Yet it is silver that is capturing the imagination of investors recently, earning it the epithet ‘The New Gold’. Traditionally, gold is seen as the dependable bedrock of value that holds firm while other investment options rise and wane. However, silver’s significant…

-

Exploring the Predicted 2025 Platinum Deficit – Insights and Implications

With the world increasingly shifting towards clean energy and electronics, the demand for platinum over the past decade has skyrocketed, outpacing any increments in supply. Looking ahead to 2025, several factors suggest a continued deficit in platinum production compared to global demand. In the auto industry, platinum’s use for catalytic convertors in diesel engines faces…

-

Why Silver is the New Gold: A Paradigm Shift in Precious Metals

In an unpredictable and fluctuating economic landscape, investors constantly seek new frontiers for stability and growth. Traditionally, gold was perceived as a safe hideout, but a new shift is looming; silver becomes the new gold. The lesser-known cousin of gold, silver holds a remarkable track record in global economics, boasting versatility unmatched by any other…

-

Driving Gold Prices to $3,500: Perspectives from Bank Of America and Kitco News

This is what it will take to drive gold prices to $3,500 The Bank of America and Kitco News have recently analysed the variables influencing the price of gold. They project a significant increase may drive the price to a mind blowing $3,500 per ounce. This forecast is influenced by several potential macroeconomic conditions such…

-

Middle-East Tensions Fuel XAG/USD: Silver Price Nearing $32.00

Emerging Middle-East tensions have prompted a notable gain in Silver prices, reflected in the XAG/USD approaching close to the $32.00 mark. The uncertainty in the region has led investors to seek refuge in precious metals, resulting in this upswing for Silver. Additionally, the market appears sensitive to geopolitical influences, given recent fluctuations. Traders and investors…

-

Understanding the Rising Gold Prices Amid US President Trump’s Tariffs

The economic landscape as shaped by the decisions and actions of US President Donald Trump have seen significant shifts in recent times. One key area of fluctuation can be seen in the rising prices of gold, a commodity traditionally seen as a safe haven in uncertain times. As the Trump administration imposes new tariffs and…

-

Economies.com | Silver Price Forecast Update 03-02-2025 | Expectations and Predictions for the Silver Market

Silver Price Forecast Update The silver market experienced significant fluctuations throughout the first month of 2025, witnessing its own share of highs and lows. Grabbing the attention of investors worldwide, the silver market now brims with possibilities. Today’s forecast points towards a potential climb in the price of this precious metal. Experts speculate a rise…

-

Gold Price Forecast: Unprecedented Highs on the Horizon

In the world of precious metals, gold prices have always held a place of prominence. The XAU/USD demonstrates this quite lucidly, and the yellow metal remains firmly on the road to challenging previous all-time highs. Economic experts attribute this growth trajectory to several key factors. Chief among them are the increasingly unstable geopolitical scenarios across…

-

Silver Prices Soar in the Market – An Unexpected Rise Reported by FXStreet

Silver soared high with a significant rise on January 16, 2025. Precious metals market analysis indicates a promising increase backed by global market factors and demand-supply dynamics. FXStreet reports that the rise in silver prices was unexpected yet favorable for investors. Silverâs stellar performance today signals optimistic forecasts for those invested in the market. As…

-

Silver Price Forecast – Continued Overhead Resistance

Silver Price Forecast â Silver Continues to See Overhead Resistance – FX Empire The silver market continues to face significant overhead resistance as investors grapple with market volatility and economic uncertainties. Despite glimmers of recovery in the global economy, the persistent challenges of inflation, coupled with geopolitical tensions, have had a profound impact on precious…

-

Gold On Track for Highest Weekly Close in Seven Weeks

As forecasters monitor the commodities market in close detail, it has become apparent that gold prices are on the track for the highest weekly closing in a period of seven weeks. The global economic tension propagated by various geopolitical factors has motivated investors to turn to gold, the perennial safe-haven asset. Consequently, there has been…

-

Volatility Hits Precious Metals Markets Amid Changes to Trade Tariffs

It was an intense day in the bullion markets with volatility hitting gold and silver prices, following a ‘tweak’ to the trade tariffs imposed by former President Trump. Analysts point out that the turbulence experienced attributes to the unpredictability that stems from changing trade policies. Despite this volatility, many investors remain steadfast in their faith…

-

Silver Price Today: Decreases on December 27th – Industry Watch by FXStreet

Silver Price Today: Dips on December 27th In the ever-fluctuating world of precious metals, silver made a noticeable dip on December 27th, according to data analyzed by FXStreet. While many market participants had their eyes on gold, experts were keeping track of the often-underestimated silver. This downward trend shows the unpredictable nature of the market…

-

FX Empire Silver Price Forecast – Potential Bounce Amid Bearish Correction

Despite the bearish correction that has been persisting within the silver market, experts are beginning to see signals of a potential bounce back. While silver has been underperforming against its golden counterpart, technical indicators suggest that there may be a shift in the trend. However, investors should keep in mind that the market dynamics can…

-

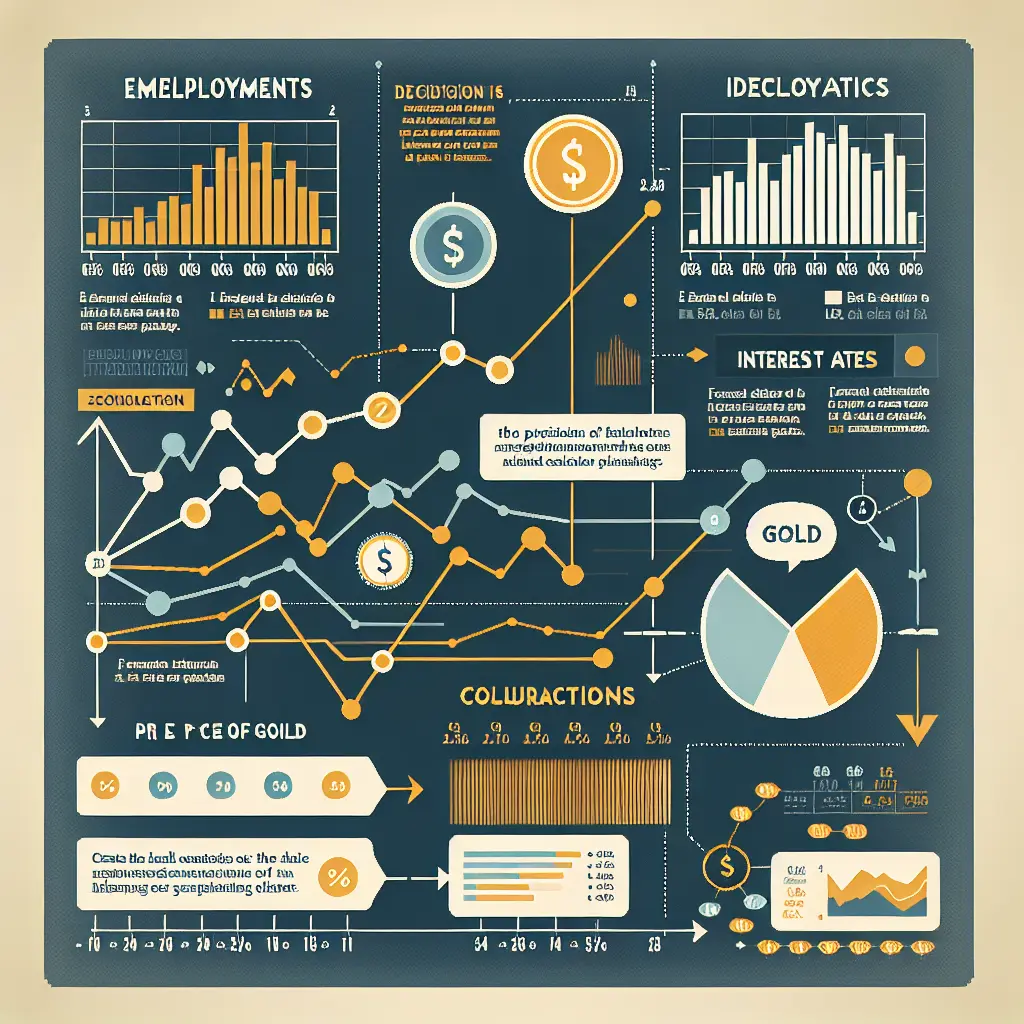

Gold Market Responds to Fed’s Hawkish Stance

Gold, a precious metal often considered a safe harbor during uncertain economic times, saw its gains erase following a recent release of US data. Indications are that this significant shift is tied to the Federal Reserve’s strengthening hawkish stance. The Federal Reserve has notably shifted towards a more assertive policy, a change that is making…

-

Gold Market Uncertainty: Rebound or Decline on the Horizon?

As we move towards the end of 2024, the gold market presents an intriguing conundrum for investors worldwide. Volatility in global markets and other macroeconomic factors have led to a tumultuous year for the yellow metal, with many questioning whether investors can expect a rebound or further decline in the coming periods. One school of…

-

Wall Street’s Outlook on Gold Prices Ahead of CPI & PPI Inflation Data

Wall Street experts are predicting a steady-to-higher trend for gold prices heading into next week. Similarly, Main Street investors are shown to be more bullish excessively. The anticipation is building up as critical CPI and PPI inflation data are imminent. These data are often a strong determinant of gold prices and, therefore, bring an air…

-

Gold’s Response to JOLTS Report and Future prospects with More US Economic Data

Gold Pares Gains Gold has pared its gains after the release of the Job Openings and Labor Turnover Summary (JOLTS) report from the U.S. Bureau of Labor Statistics, investors are now eyeing additional U.S. economic data for further direction. The JOLTS report highlighted the condition of the U.S. labor market, with data that potentially may…

-

Will the Federal Reserve’s potential rate cuts lift gold prices?

The precarious state of the job market and its potential impact on the Federal Reserve’s rate decision is currently the focus of gold-obsessed investors. With the labor market showing signs of weakness, there is an increasing likelihood of the Fed implementing rate cuts to stimulate economic growth. Lower rates generally lift gold (XAU) prices as…

-

Gold Price Forecast Update: A Potential Shift on The Horizon – Economies.com

Gold, a commodity that is often viewed as a safe-haven investment in times of economic uncertainty, is showing unexpected moves on the forecasting horizon. According to Economies.com, the gold prices could take on an exciting turn as we approach 25-11-2024. This potential shift might be the result of multiple factors including geopolitical tensions, market volatility,…