Category: Finance and Investments

-

Shifting Trends in Precious Metals: Silver May Soon Outrun Gold

While gold has been experiencing a significant run, the silver rally has so far been left in its dust. However, financial analysts are now predicting a shift in this trend. They point to several indicators suggesting that silver may soon begin to outperform gold. Factors such as rising industrial demand, increasing investment interest, and economic…

-

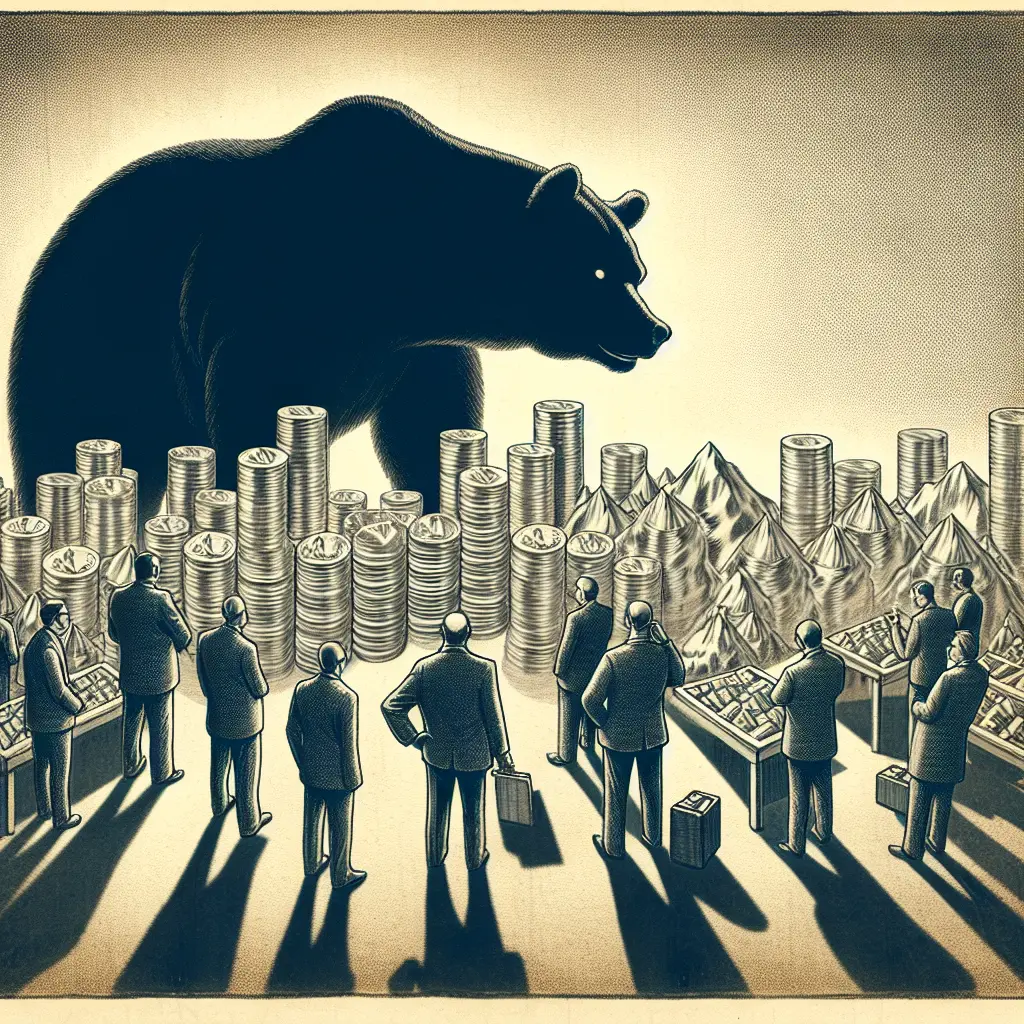

Silver Price Drops Below $33 – Is The Bull Market Over For Now?

In an unexpected turn of events, the XAG/USD pair, also known as Silver, has slid below the $33.00 level. This downtrend is a significant point in the current financial market scenario as it has implications on investor sentiment and future trading strategies. The 200-period Exponential Moving Average (EMA) on the 4-hour chart comes up as…

-

Gold Forecasts Warn of Bearish Trends Despite Recent $3,500 High

In the unfolding economic drama, gold has been playing a notable part. It recently peaked at a record $3,500 high, evoking great excitement among investors and traders. However, goldâs subsequent formation of a bearish pennant pattern has given reason for pause. A bearish pennant is a pattern used in technical analysis that is considered to…

-

FOMC Decision Spurs Record-Breaking Surge in Gold Price – FXStreet | Finance and Investments

In a historic development, gold prices have set a new milestone, spurred by decisions made at the recent Federal Open Market Committee (FOMC) meeting. Gold’s price surge demonstrates its enduring value as an investment in times of economic uncertainties, and further established gold’s position as a safe haven asset. This turbulence in the market has…

-

Top 10 Cryptocurrencies Of March 11, 2025 – A Forbes Analysis

In the rapidly evolving world of cryptocurrencies, it’s vital to stay ahead of the game. Forbes brings to you the top 10 cryptocurrencies as of March 11, 2025. Here are the digital assets that are making waves in the cryptocurrency market. n1. Bitcoin (BTC) – Retaining its long-held position at the top, Bitcoin continues to…

-

Record High Gold Prices Sprint Towards $3,000 Milestone – Reuters Analysis| Gold in Global Economy

In a remarkable surge, gold prices have scaled to a record high, steering swiftly towards the $3,000 milestone, as reported by Reuters. This historic rise is attributed to numerous factors such as economic uncertainties, inflationary pressures, and the increasing demand for safe haven investments. Global markets have been witnessing a broiling mix of volatile conditions…

-

Gold/Silver Price Suppression Failing? Market Analysis by Andy Schectman

In the ever-dynamic global financial market, a significant occurrence is posing questions among commodities traders. Is the suppression of gold and silver prices failing? Andy Schectman, a seasoned market analyst, sheds light on this phenomenon in his recent expose published in The Jerusalem Post. According to Schectman, the traditionally used tactics for price suppression might…

-

Gold Prices Slide Due to Increased Profit-Taking and Weak Long Liquidation

The ongoing trend of profit-taking and weak long liquidation continues to weigh heavily on the gold market, reports Kitco NEWS. Following an initial surge, the price of the precious metal experienced a downward shift that has left investors and market watchers alike concerned. Industry experts are attributing this decline to profit-taking maneuvers by investors who…

-

Choppy Behavior Continues to Dominate Silver Price Forecast – FX Empire

Silver Price Forecast â Silver Continues to See Choppy Behavior – FX Empire The silver market has continued to show a high degree of volatility, with prices oscillating in a broad range. It’s been a choppy trading environment reflecting a variety of market dynamics at work, from sector movements, global economic trends to Federal Reserve…

-

Examining the Potential for Further Increases in Gold Prices – Market Analysis by Barron’s

With the increasingly volatile global economy, Wall Street analysts are attempting to predict the trajectory of gold prices – a traditional safe harbor in unsure economic times. Uncertainty surrounding global events, from ongoing geopolitical tensions to fluctuations in financial markets, has pushed gold prices to record highs. The question that remains is: How much higher…

-

Analyzing the Potential for a 30% Drop in Gold Prices

Gold, traditionally viewed as a ‘safe haven’ investment, has witnessed its prices increase dramatically over the past decades. Yet the question arises, Can Gold Prices Drop 30%? The answer lies in the complex dynamics of the global economy, market sentiment, and investment strategies. While it’s not unprecedented for steep falls in gold prices, a 30%…

-

Analysis of Gold Prices in India on December 30th, 2024 – A Detailed Insight by FXStreet

Gold price in India: Rates on December 30 – FXStreet On December 30th, 2024, the price of gold in India experienced dynamic shifts reflecting on the country’s economy and the global gold market. Factors affecting this fluctuation ranged from local demand, international market trends, and changes in the forex market. Stay connected to FXStreet for…

-

Gold’s Bullish Forecast Targets 2,644 – FX Empire

According recent financial data trends and market factors, gold prices are targeted to reach a 20-day moving average at 2,644. This bullish view on gold is backed by a variety of global uncertainties that have increased its value as a ‘safe haven’ investment. The market flux, coupled with increased demand and limited supply, are primary…

-

Anticipating Steady Gold Prices Ahead of the Fed’s Projected Rate-Cut in 2025 – Coverage by BullionVault

Gold markets have shown remarkable steadiness as investors await the Federal Reserve’s expected rate cut in 2025. The prospect of reduced interest rates, often a catalyst for increased gold investments, has yet to disrupt the bullish gold market. The tranquility suggests a strong confidence in the gold market and a robust expectation of positive yield…

-

Exploring the Potential of Silver Outpacing Gold in the year 2025 – An expert’s opinion

As we approach 2025, the precious metals market is abuzz with speculations and forecasts. One rampant question that market observers seem fixated on is – ‘Can silver outpace gold in 2025’?nnThe price of gold has traditionally dominated that of silver. However, several financial experts and market analysts believe that this could change in 2025. There…

-

Exploring Cryptoderivatives: A Look at the Future of Finance

Cryptoderivatives: On the Rise The financial world is no stranger to readjusting its lens, with emerging markets and innovations perpetually demanding attention. Enter cryptoderivatives. Paralleling the breakthrough of digital currencies, cryptoderivatives signify the evolution of the financial sector, encompassing a gamut of products from futures contracts to options, all linked with the volatile yet enticing…

-

Gold Price: Trimming Gains Amid US Inflation, Finds Support in Softer Dollar

Despite the U.S having robust inflation data that suggested a trimming of gains, the prices of gold found just the right kind of support from a softer dollar. The currency’s drop-in strength meant that gold’s appeal as an alternative asset grew stronger among investors. The precious metal’s price was also responsive to speculations around global…

-

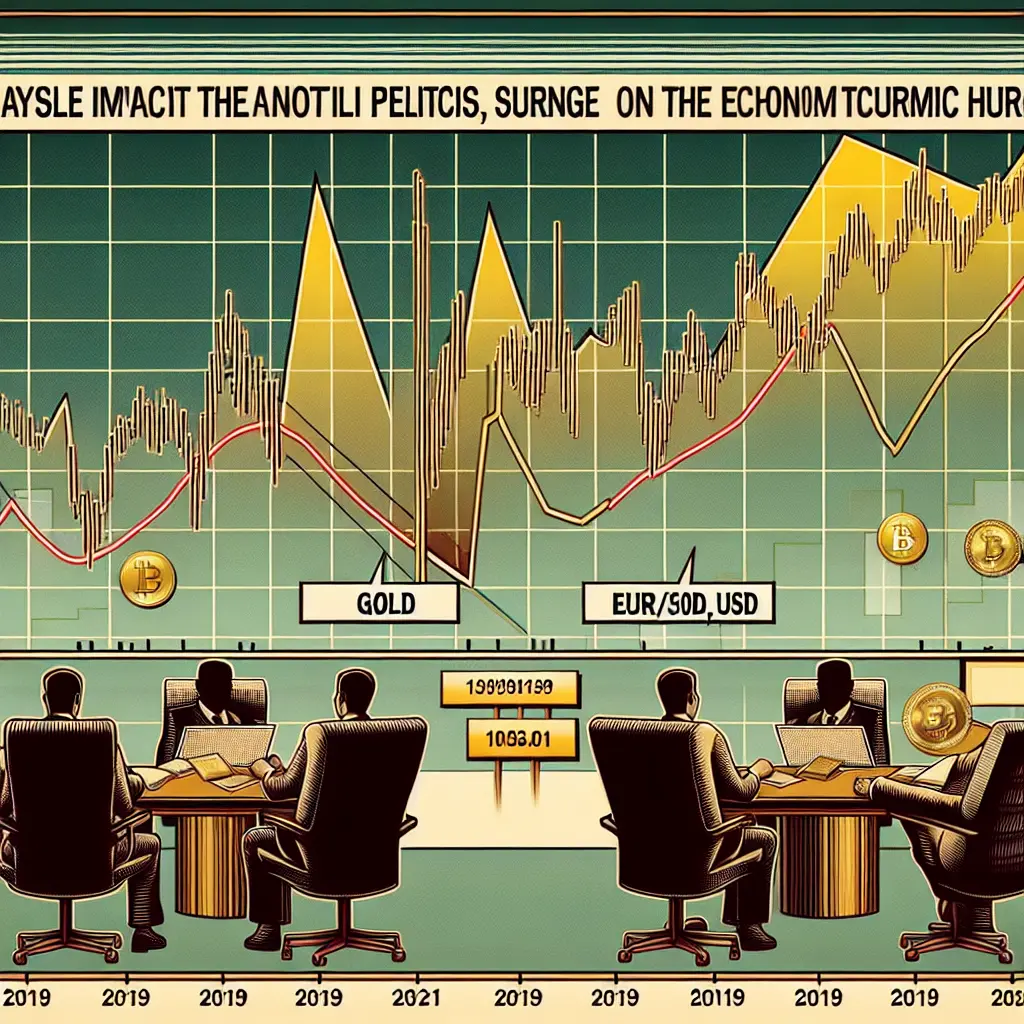

Understanding Trump Bump Price Action on Gold, Bitcoin, EUR/USD, SPX

We’re witnessing an interesting phase in the financial market with ‘Trump Bump’ price influence causing fluctuations in commodities like Gold and digital currency like Bitcoin, along with EUR/USD and SPX. It appears that any speculation to the future actions of the Trump administration can result in immediate market reactivity. Gold, traditionally considered a safe haven…

-

Silver Price Forecast: Indications of Weakness Detected – FX Empire

In the world of precious metals, silver has been showing signs of weakness, as depicted by the bearish engulfing pattern. This pattern, visible in the silver price charts, traditionally signals a turn in sentiment from bullish to bearish.nnSuch a pattern has been a reliable indicator of a potential price drop in many markets and seems…

-

Gold Sees Solid Price Gains Due to Safe-Haven Demand – Kitco NEWS

According to recent reports, the price of gold has seen significant gains due to its status as a safe-haven investment. This development comes as investors gravitate towards more reliable assets amidst the fluctuations in the global market. Traditionally, gold is seen as a stable store of value, making it a popular choice during times of…

-

Gold Price Forecast: Has Gold Topped? – FOREX.com US Financial Update

In this constantly fluctuating economy, investing in gold has always been a safe haven for many investors. However, there has been a question looming amongst investors, ‘Has Gold Topped?’. The recent surge in gold prices has led to mixed speculations about the future trajectory of this precious metal. Some believe that the gold price has…