Category: Financial News

-

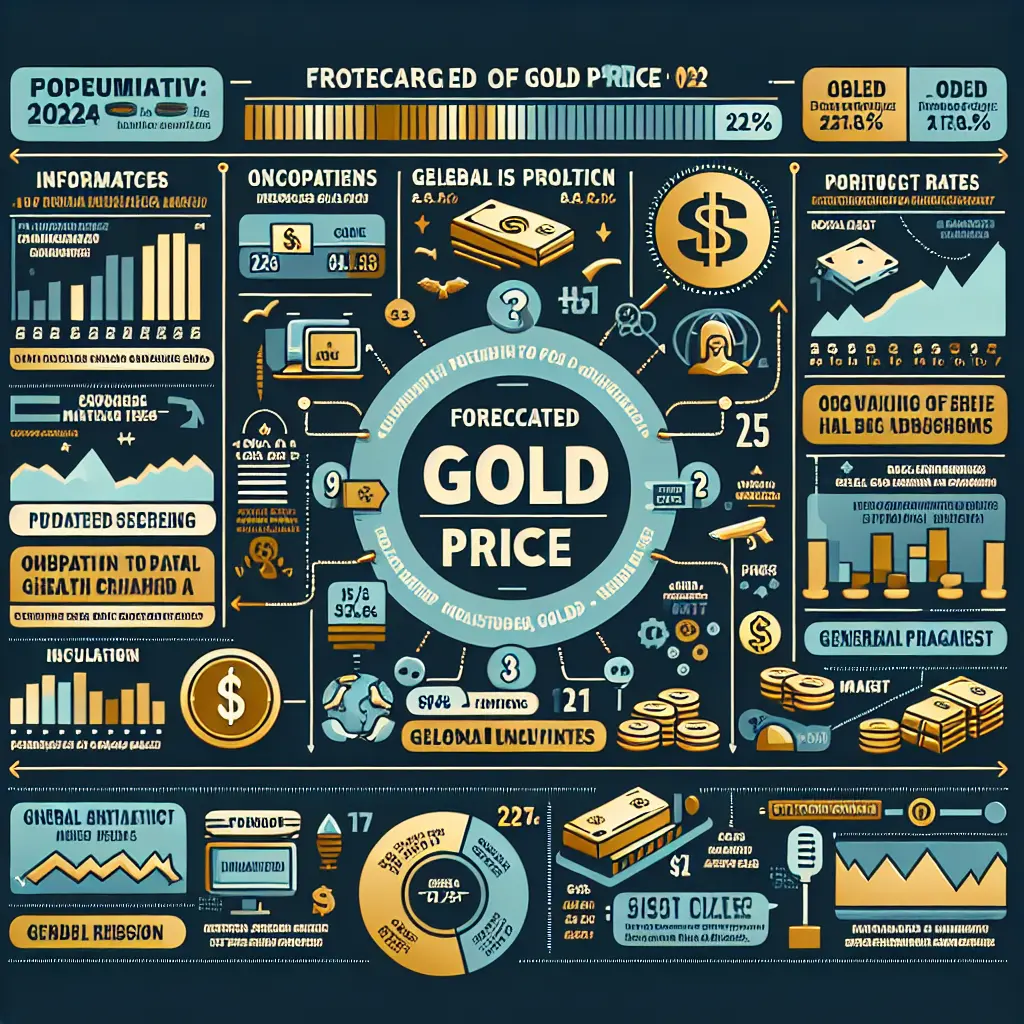

FX Empire Forecasts Gold Price Rise to $2,644 as per 20-Day Moving Average

Gold, the shimmering harbinger of prosperity, is experiencing a significant surge in prices. The 20-Day Moving Average, a vital marker for investors, is forecasted to soar to a promising $2,644, according to FX Empire. This potential rise has been anticipated due to a compilation of factors, including economic climate, world affairs, and market trends. With…

-

US Fed Signals 2 Rate Cuts in 2025 Causing Gold, Silver Prices to Fall

In an unprecedented move that has shocked the commodities market, gold and silver prices have experienced a significant downturn. This is in direct response to the U.S. Federal Reserve’s signal of only two rate cuts in 2025. This revelation by the US Fed, the central bank of the world’s largest economy, has caused ripples in…

-

Silver Price Slides After Initial Gains – Understand the Market with FX Empire

The price of silver, a sought-after precious metal with versatile uses, gave up its early gains on the trading day of Thursday. The market underwent a brief uptick in the earlier hours before witnessing a sharp decline. This fluctuation exhibits the level of volatility prevalent in the precious metals market. Despite the day’s loss, the…

-

Investing News Network: Silver Price 2024 Year-End Review

As the year 2024 draws to a close, the silver market has demonstrated resilience and potential for growth despite the various economic challenges faced. With a steady incline in demand coupled with limited supply, the price of silver saw moderate fluctuation, ultimately yielding a favorable return on investment for those in possession of this precious…

-

Silver Price Takes a Dip: An Unforeseen Shift in Thursday’s Market

In an unexpected turn of events, the silver market traversed a volatile path on Thursday. Starting off on a positive note, silver prices exhibited early gains, strengthening speculations around its future performance. However, as the day unfolded, the prices took a dip, with silver relinquishing its early gains. Innovative profit-taking strategies and the inherent dynamics…

-

Bitcoin’s Potential Surge to $500,000 with US Investment

As we navigate the ever-evolving crypto landscape, a startling projection was made by a Chief Investment Officer (CIO) of an established crypto fund. The CIO suggests that the value of Bitcoin could hit a staggering figure of $500,000 if the US government makes a decisive foray into the digital token realm. This prediction, while far-reaching,…

-

Shockwave in Gold Market: Prices Drop Over 2% After Fed’s 2025 Rate-Cut Slowdown Signal

In an unexpected turn of events, the price of gold has plunged by over 2% following signaling from the Federal Reserve that it would be slowing down rate cuts in 2025. This move has sent ripples through the global market, shaking investor confidence in gold as a reliable safe haven. The Federal Reserve’s monetary policy…

-

Silver Consolidates around $30.55: XAG/USD 100-day SMA – FXStreet

Silver Price Forecast: XAG/USD consolidates around $30.55 area, 100-day SMA In the world of precious metals, one interested group who always keeps an eye on silver prices is the trading investors. Lately, the XAG/USD has been consolidating around the $30.55 mark area, a notable shift observed in the 100-day Simple Moving Average (SMA). This particular…

-

Silver Price Forecast Update – A Deep-Dive Into Future Market Trends

Silver prices have oscillated in unique patterns over the previous quarters, and analysts are turning their lenses towards what the future holds. As of 17th December 2024, renowned traders and financial pundits are prophesying an exciting era for this precious metal. The price of silver continues to engage investors due to its intrinsic value and…

-

Gold Retreating on Predictions of Slowed Fed Rate Cuts for 2025 – Financial News

Gold Retreats as Traders See Slower Fed Rate Cuts in 2025 On the blustery morning of December 17, 2024, gold has been seen retreating as traders predict a slowdown in the Federal Reserve’s rate cuts for the approaching year. As there’s been distinct chatter around a potential decrease in the rapidity of said cuts by…

-

Gold’s Leap as US Dollar Dips Before Federal Reserve Policy Meeting

Gold prices escalated today, as the US dollar took a backseat, easing investors worldwide. This movement comes as a precursor to the much-anticipated Federal Reserve policy meeting. Gold, an asset often seen as a safe haven during times of financial and economic uncertainty, saw an increase in its value. Market analysts attribute this rise to…

-

Gold Price Hurdles: Federal Reserve Meeting Perspective

As the Federal Reserve’s pivotal meeting inches closer, the price of the gold is bracing to navigate through potent headwinds. Market players are holding their breath, closely monitoring the fluctuating value of the precious metal. Experts portend that predictions from the Fed regarding economic policies and interest rates will greatly influence the future course of…

-

Bitcoin Hits Historic $100,000 Milestone – A Shakeup in Financial Industry

Bitcoin price hits $100,000 for the first time – NBC News Breaking news, collective shockwaves reverberated across the financial industry as Bitcoin, the world’s leading cryptocurrency, breached the $100,000 mark for the first time in history. The unprecedented milestone, recorded on Dec 5, 2024, has proven Bitcoin’s enduring value and its growing recognition as a…

-

Gold Price Forecast December 2024: Predictions and Trends – CBS News

As we approach the end of 2024, the financial world turns its eyes towards the shiny yellow metal, Gold. Given its status as a safe haven during uncertain times, it becomes increasingly relevant to predict its performance in the coming month of December. Several factors could impact the price of goldâthe ongoing pandemic situation, inflation…

-

Silver Market Making Strides as Prices Rise on December 3 – FXStreet

The financial markets opened to a jubilant rise in the price of silver on December 3, as reported by FXStreet. After a period of stagnant prices, silver traders and investors worldwide rejoiced at this upward progression. The silver market, like any other, is susceptible to global economic trends and is hence often unpredictable. However, analysts…

-

JPMorgan’s Forecast: Gold and Silver Price Outlook for 2025 and 2026

World-renowned banking powerhouse, JPMorgan has released its prophetic outlook for the prices of gold and silver for the years 2025 and 2026. Informed by an exhaustive analysis of market dynamics, geopolitical events and economic indicators, the report presents a comprehensive forecast of precious metals movement that is critical for both seasoned investors and new market…

-

Gold’s U.S. Market: A Predicted Quadrupling and its Implications on Gold Prices

Gold’s U.S. Market Share to Quadruple? What Happens to Gold Price When That Happens â Rick Rule – Kitco NEWS On a surprising turn of events, the U.S. market share in the gold industry is expected to explode, quadrupling in scope. According to Rick Rule, a seasoned expert in the field, the implications of this…

-

Silver Price Forecast: The Future Uncertain – FX Empire

Silver Price Forecast: At a Crossroads that Could Swing Either Way – FX Empire Published on Dec 02, 2024 The price of silver appears to be at a significant juncture, according to industry experts. This point of intersection could see the prices swing in either direction, depending on various factors currently influencing global markets. Major…

-

Gold’s Price Rebound Halved as China’s Demand Plummets

The lure of the precious metal, gold, experienced a notable decline last week, cleaving its price rebound in half. This chilling response is primarily attributed to China’s dwindling demand for gold. China, being one of the major global consumers of gold, has witnessed a substantial drop in the demand for the bullion. This has spiraled…

-

Silver Surges Amid Russia-Ukraine Conflict – XAG/USD Forecast

As the tension escalates in the Russia-Ukraine conflict, it’s causing ripples in the world of precious metals. Silver (XAG) as a result, saw a substantial bounce on the USD; a trend that financial analysts had not expected. This comeback is fueled by the uncertainty that the geopolitical situation presents, fostering a clear ‘flight-to-safety’ scenario among…

-

Gold Prices Fall, Reviving Physical Demand in Key Markets

Falling Gold Prices Revive Physical Demand in Key Markets Physical demand for gold has seen an unexpected uptick in key markets, a phenomenon that can be attributed to the falling prices of the precious metal. Recent data suggest that purchasers in crucial markets are capitalizing on the favorable circumstances to invest in gold, thereby reviving…

-

Making Wise Gold Investment Choices: Top Picks and What to Avoid for 2025

4 Gold Investments to Consider for 2025 (And 4 to Avoid) n As we near the year 2025, it is imperative for investors to make wise and informed decisions about where to place their gold investments.nn ## Gold Investments to Considernn1. Physical Gold: This timeless classic remains one of the safest bets in the financial…

-

Embracing the Bearish Momentum in Gold Price: Forecasting and Analysis

In an unexpected turn of trends, the gold prices showcased a bearish momentum, stifling the previous bullish reversal. This contradictory behavior of the gold market exposes prospective investors to a possible risk, thereby emphasizing the unpredictability of the gold market. Additionally, this flip in momentum also denotes the volatile nature of the gold prices, making…

-

Silver Price Forecast indication: Bearish Engulfing Pattern Signals Potential Price Weakness

In the tumultuous world of precious metals, the recent price movements of silver have caught the eye of global investors. A bearish engulfing pattern, a chart pattern that can herald potential downtrends, has been spotted on silver price charts, marking a must-watch moment for those tracking the metal’s performance. The bearish engulfing pattern is a…

-

Gold Market Shaken by Israel-Hezbollah Ceasefire and New US Treasury Pick

Gold prices experienced a significant drop, tumbling over 3%, on reports of a ceasefire agreement between Israel and Hezbollah. This along with the recent selection of a new US Treasury pick has added to the volatility of the market. Investors typically view gold as a safe haven asset in times of political or economic uncertainty.…

-

Bitcoin Hits Record $94,000 High, Continues Exceptional Growth Trajectory

In an unprecedented display of growth, Bitcoin, the leader of cryptocurrency market, has reached a record-breaking high of $94,000. Bitcoin, as the flagship asset, has consistently trumped its previous benchmarks, setting itself apart from other cryptocurrencies and redefining the financial landscape. Due to its unfettered growth, Bitcoin has caught the attention of investors globally. With…

-

Geopolitics and Fed Moves causing Gold Price Swings: An Analysis

In the dynamic world of precious metals, events on the global stage and moves by the Federal Reserve (Fed) in the U.S are key shapers of gold prices. The bewildering interplay of geopolitics and Fed policies have significantly impacted gold prices, causing swings that have left investors on edge. Geopolitics, defined by international relations influenced…

-

Analyzing 3 Crypto Stocks: Marathon, Coinbase, MicroStrategy Amidst Potential Bitcoin Surge

With Bitcoin living up to its volatile nature, the possibility of it crossing the $120K mark needs a strategic analysis. Here are three crypto stocks to consider: Marathon, Coinbase, and MicroStrategy. These giants offer a promising landscape for investors ready to capitalize on the possible Bitcoin crossover. Marathon Digital Holdings Marathon is one of the…

-

State Based Bitcoin Reserves: A Forward Push for Pro-Crypto Policies

In an era of economic uncertainty and evolving regulatory landscapes, states actively engaging in establishing Bitcoin reserves can play a pivotal role in propelling pro-crypto policies forward. The idea, revolutionary in its essence, is grounded on the decentralized nature of cryptocurrencies, and their potential to bring notable financial autonomy to states. State-controlled Bitcoin reserves could…

-

Gold Records 5% Gain on Week’s End – Safe-Haven Demand Drives Price

In a dramatically volatile week, the price of gold witnessed a significant gain, appreciating by 5%. This uptick has been driven primarily by investors seeking refuge amidst macroeconomic uncertainty, thereby boosting safe-haven demands. n nThe yellow metal stood out as an asset of choice for investors looking to safeguard their portfolio from volatility in equity…