Finance, Gold, Crypto and Silver Updates 24/7

-

As the global economy continues to navigate through the paradigm shifts, all eyes remain steadfast on the gold market.…

-

Forbes Top 10 Cryptocurrencies Of April 15, 2025 – Bitcoin Tops The Chart with Ethereum Behind

As the world continues to ride on the wave of digital currency adaptation, we present to you the top…

-

Top 8 Performing Cryptocurrencies in 2025 – In-depth Analysis

As the crypto market steers into the second quarter of 2025, certain cryptocurrencies have taken the forefront, emerging as…

-

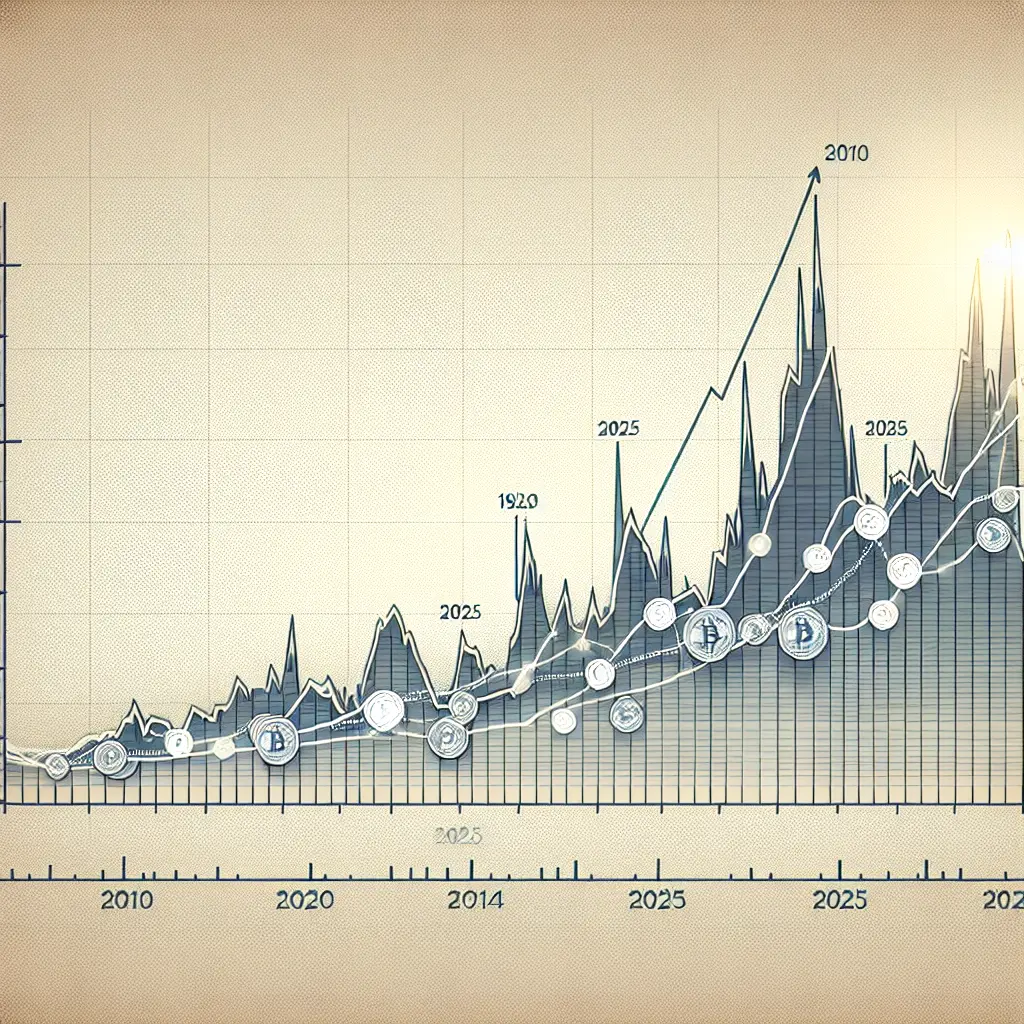

Unprecedented growth of Crypto Market Cap from 2010 to 2025

From an obscure entity in 2010 to a prominent financial venture in 2025, the crypto market cap has witnessed…

-

Silver’s Price Dip Amidst Easing Trade Concerns – A Temporary Setback or a Continuing Decline?

Silver, also known as the poor man’s gold, witnessed a significant drop in its value as the XAG/USD pair…

-

Silver Institute 2025 Survey Predicts Rise in Silver Prices due to Persistent Supply Deficit

The Silver Institute, in its 2025 Survey, foresees a persistent supply deficit propelling the price of silver significantly higher.…

-

Bullish Bias Remains for Gold & Silver Despite Powell’s Hawkish Tone

The precious metals market continues to display resilience despite the Federal Reserve Chairman, Jerome Powell’s, hawkish stance. While some…

-

Gold Price Forecast: Surprising rates amid trade tension – Economic Times

Amid rising global trade tensions, the prediction of gold prices has taken a staggering turn. Noted financial experts forecast…

-

Record High Gold Prices: Unpacking the Surge in Gold Investment – Investopedia

In an unprecedented turn of events, gold prices soared dramatically to a record high this past Wednesday. This surge…

-

Gold Price Sees Significant Drop from Historical High

In a surprising twist in the economic landscape, the price of gold has seen a drastic drop today. The…

-

Analyzing the Top 10 Cryptocurrencies of April 15, 2025

Top 10 Cryptocurrencies Of April 15, 2025 – ForbesnnCryptocurrencies are rapidly redefining the landscape of global finance. Here, we…

-

Top 8 Cryptocurrencies of 2025: Uncovering the Best Performers | Bankrate

Cryptocurrencies have been on the global stage for a few years now, and by 2025, they have truly gained…

-

Crypto Market Cap 2010-2025: A Historical and Projected Analysis by Statista

Overview The evolution of the cryptocurrency market capitalization from 2010 to 2025 shows remarkable growth. It provides an evidential…

-

Silver Price Drops Below $32.50 Amid Easing Global Trade Concerns

In recent news, the price of Silver (XAG/USD) has taken a step back and is currently projected below the…

-

Bullish Bias Intact for Gold (XAUUSD) & Silver Despite Powell’s Hawkish Tone according to FXEmpire

In an unexpected turn of events, the gold (XAUUSD) and silver markets have remained bullish despite the hawkish tone…

-

Expert Predictions on Gold Price: Will it Fall or Continue Rising?

In the unpredictable world of gold trading, experts have once again put forward their experienced verdicts in an attempt…

-

Significant drop in gold prices today, reasons behind sharp fall from historic highs revealed

In an unpredictable turn of events, the gold price has seen a significant drop today, marking a sharp fall…

-

Best Crypto In 2025: Top 8 Cryptocurrencies Portfolio – Bankrate

With the rapid technological evolution and increasing public awareness, cryptocurrencies continue to take the financial world by storm. Here…

-

Bitcoin, XRP Prices On An Upward Trend – A Look Into The Next Potential Crypto Surge

Bitcoin and XRP, two of the most authoritative cryptocurrencies in the worldwide blockchain space, are showing an upward trend…

-

Analyzing the Crypto Market Cap from 2010 to 2025 – Insights from Statista

The dawn of the 2010s introduced the financial world to cryptocurrencies, a new asset class that would eventually evolve…

-

Silver Price Forecast Dips as Trade Concerns Diminish – A Detailed Evaluation

The price of silver, tracked by the XAG/USD pairing, has seen a downward adjustment below the $32.50 level, primarily…

-

Silver Prices Set to Soar due to Persistent Supply Deficit – Findings from the Silver Institute 2025 Survey

In a recent survey released by the Silver Institute and KITCO, predictions indicate a persistent supply deficit that is…

-

Gold & Silver Price Forecast: Bullion Market Reacts to Fed’s Cautious Tone

Gold (XAUUSD) & Silver Price Forecast: Bullion Stalls as Fed Signals Caution Essentially an impact of announcements made by…

-

Gold and Bitcoin: A Historical Trend Shows a Correlation in Their Prices

Price trends in the precious metal gold have been linked to similar trends in Bitcoin, the world’s largest cryptocurrency.…

-

3 Potential Gold Price Scenarios This April – An Expert Insight

As we enter into April, it’s a pivotal moment for those invested in or considering investing in gold. Historically,…

-

Understanding the Role and Impact of Market Makers in Crypto

Who are market makers in crypto? Role and impact explained In the expansive world of cryptocurrencies, market makers have…

-

Ethereum Leads as the Most Expensive Cryptocurrency of 2025 – Statista

As we move further into the second quarter of 2025, one cryptocurrency continues to lead the pack in terms…

-

Exploring the Factors Behind the Recent Dip in Bitcoin and XRP Prices

In the volatile world of cryptocurrencies, Bitcoin and XRP prices have recently experienced a significant dip. While these fluctuations…

-

Silver Price Today: Significant Increase on April 16 – FXStreet

In a surge reflective of investor confidence, the price of silver ascended remarkably on the 16th of April. The…

-

Gold & Silver Price Forecast: Bullish Breakout due to Global Tariff Chaos – FXEmpire

Gold (XAUUSD) & Silver Price Forecast: Bullish Breakout as Tariff Chaos Fuels Demand – FXEmpire As recent global tariff…