Tag: Commodities Market

-

Silver Price Forecast: Limited Downside Despite Dip Below $32.00 – FXStreet

In a surprising turn of events, the XAG/USD pair has slipped below the psychological level of $32.00. The recent dip in silver prices, however, appears to be a minor setback, as experts forecast limited downside potential in the near term. This dip is primarily attributed to the strengthening of the U.S. dollar and fluctuating global…

-

Silver Price Outlook – Will Silver Find Its Momentum Amid Market Turbulence?

As of Thursday, April 10, 2025, the silver market continues to seek consistent gains to build momentum. Prompted by mixed market dynamics and stability in the dollar’s strength, silver speculators patiently await a decisive turn. Despite global uncertainties, silver has retained its shine and potential for growth. However, the momentum silver needs to observe resides…

-

Silver Price Resiliency: Bullish Trend Defends Key Support as XAG/USD Eyes $30 – FXStreet

Given the recent fluctuations in the global economy, the silver market has shown its tenacity as XAG/USD rallies toward $30. This rebound signifies a strong defence by the bulls of the key support levels. The past week has seen the XAG/USD hit lows that have been expertly resisted by market bulls, leading to this current…

-

Silver Sluggish in Wake of Fed’s Rate Decision, Trades Below $34.00 – Commodity Market Update

Following the Federal Reserve’s decision on interest rates, the XAG/USD continues to trade below $34.00. The decision, which was widely anticipated by market observers and investors alike, has had a far-reaching impact on the commodities market, with silver being notably affected. Despite favorable market conditions and ongoing economic recovery, the silver price has failed to…

-

Understanding Silver Price Movements: Consolidation During Early Friday Trading

The silver market saw a consistent consolidation in the early trading hours of Friday, as investors took stock of the current economic backdrop. With the U.S Federal Reserve recently hinting towards potential interest rate hikes, it seems silver traders are taking a cautious approach amid the economic uncertainty. Silver prices remained relatively stable, hinting at…

-

XAG/USD Rises to Five-Month Highs, Reaches $33.50 – A Bullish Outlook for Silver?

In a turn of events captivating commodities market spectators worldwide, Silver witnessed a near five-month high increment, with XAG/USD hitting the $33.50 mark. This rise, according to market analysts, is indicative of an overall bullish momentum in the precious metals sector. It is intriguing to note that despite the prevalent disturbance in geopolitical conditions, this…

-

Gold Price Surge Amid US Inflation & Trump’s Metal Tariff

The gold price has escalated, causing ripples in the financial and commodities markets. This rise comes as traders process the implications of US inflation trends and the impact of metal tariffs introduced by former President Donald Trump. These tariffs, aimed at protecting American industries, have indirectly influenced gold prices. The stimulus packages in the aftermath…

-

Gold in Favourable Position Anticipating FOMC Minutes Release – FXStreet Analysis

Gold poised to end week with profits ahead FOMC minutes – FXStreet As we approach the end of the trading week, markets are anticipating the imminent Federal Open Market Committee (FOMC) minutes with bated breath. Preliminary indications suggest that gold maybe on a poised favorite spot to conclude this week on a high note, recording…

-

Silver Soars – Unpredicted Market Performance Forecasts Higher Price Trends

In an exciting turn of events, silver prices soared high this Friday, outperforming expectations. The bullish trend was primarily driven by market investors turning to traditionally safe assets amid global economic uncertainties. Silver, being an industrial and precious metal, holds intrinsic value that tends to make it an attractive investment during such turbulent times. The…

-

Silver’s Price Outlook – Hammering takes a Toll; What Lies Ahead?

In a shocking turn of events, the outlook for the silver price experienced a sharp decline. This downturn has left investors and traders alike scrambling to understand the implication of this trend. Among other precious metals, silver bore the brunt of the hammering in the commodities market, with prices sinking in response to multiple combined…

-

Gold Price Forecast: Witnessing Retreat After Record Peak – FX Empire

In a striking turn of events, Gold value took a retreat soon after reaching the landmark figure of $2,882, etching its name in the history books. The record high, pushed by a series of geopolitical events and uncertainty, soon saw a pullback as traders booked profits and the market corrected itself. The yellow metal’s allure…

-

Silver Price Today: Notable Surge on January 6 – Detailed Analysis by FXStreet

In the precious metals market, a notable shift has occurred with the sharp rise in silver price today, on January 6th, as reported by FXStreet. Market analysts suggest several reasons behind this surge, including increased interest from investors seeking safe havens amid geopolitical unrest and expectations of an industrial demand spike in the upcoming year.…

-

Silver Market Drama: XAG/USD Bears Dominate as Prices Struggle Below 200-day SMA

In the latest twist to the silver market, XAG/USD bears are dominating the trading charts, keeping silver prices below the 200-day Simple Moving Average (SMA) of $30.00, as reported by FXStreet. This pricing trend is influenced by several global market factors, including the US Dollar’s strength, the stock market’s performance, and geopolitical tensions. As traders…

-

Silver Price Weekly Outlook: Selling Pressure Persists – FX Empire

The silver market is enduring hefty selling pressure, observable in this week’s performance. Traders and market pundits alike are keeping a wary eye on the delicate equilibrium of demand and supply factors. This, coupled with macroeconomic uncertainties which are increasingly impacting the strength of leading global currencies. On one hand, silver demand, particularly for industrial…

-

Pullback and Consolidation in Silver Prices: An Indication of What’s Next?

After a long period of bullish trend, the price of silver appears to be settling into a period of consolidation. Market enthusiasts and investors need not be alarmed – this pullback is a natural part of market movement, especially after a phase of intense growth. On analysis, technical charts suggest that silver is preparing to…

-

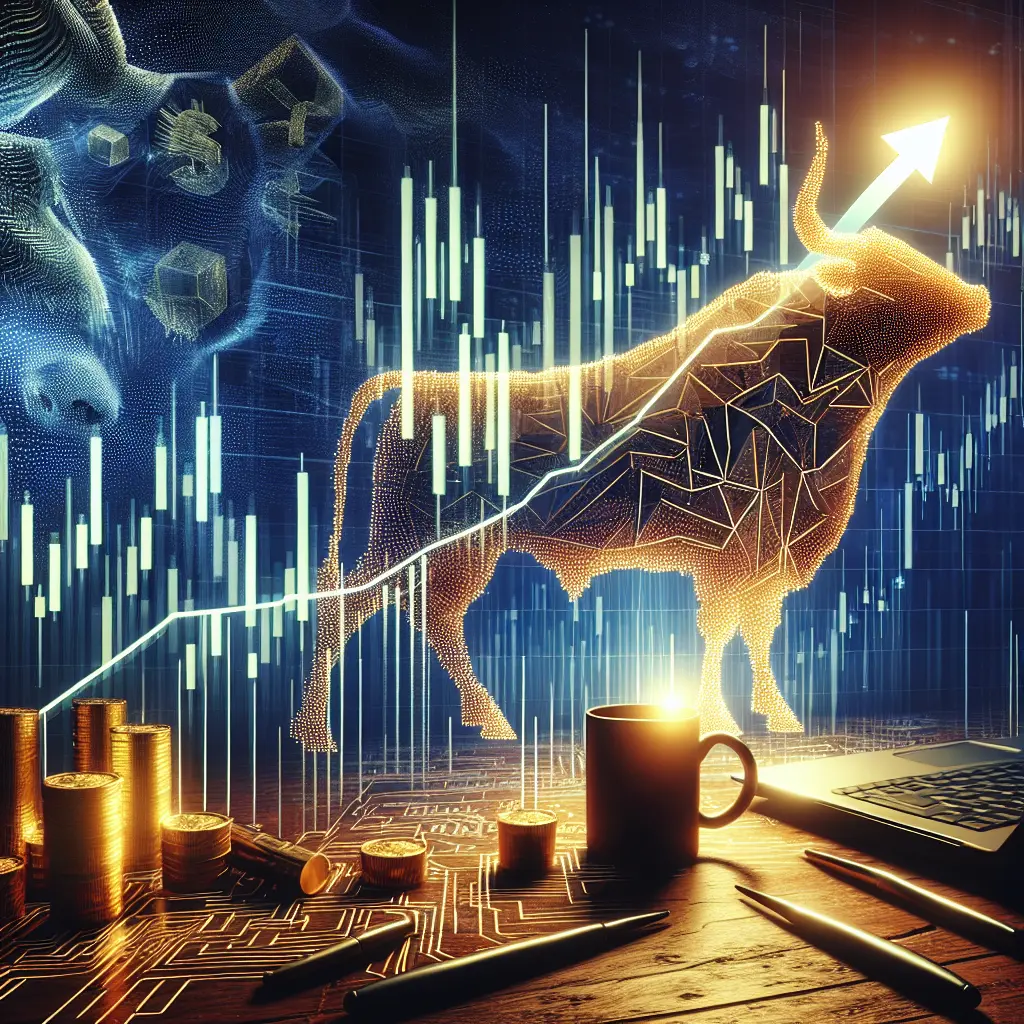

Gold Price Rebounds Strongly with 2% Increase, Goldman Stands By $3,000 Target

In an impressive rebound, the gold price shot up by 2%, invigorating investors with positivity and renewed confidence. This eye-opening movement was further solidified by Goldman’s unwavering reiteration of its $3,000 target. This announcement came as a reaffirmation of the solid performance of gold in the market, underlining its resilience in uncertain economic climates. Industry…

-

Bullish Hammer Pattern Signals Potential Rise in Gold Price

As we delve into the intricate world of bullion trading, a bullish hammer pattern hints at a possible recovery in the price of gold. The pattern, observed in the recent fluctuations of gold prices, suggests a bullish trend, which could reinvigorate the gold market. This classic reversal pattern, which can be spotted in price charts,…

-

Gold Price Forecast – Support Continues Despite Selloff

Despite a recent selloff, gold prices continue to find substantial support in the market. Looking at the overall scenario, it’s clear that the yellow metal has remained a favorite among investors. The selloff phase generated a certain fear sentiment, but instead of panicking, investors have stepped in with confidence, leveraging the drop to accumulate more…

-

Global Silver Market Sees Significant Rise – XAG/USD Edges Above $32.50

In a much-anticipated economic turn, the silver market is now seeing a significant rise. With the XAG/USD hitting, and swiftly surpassing, a high of $32.50, this positive momentum indicates the start of a bullish period in the silver market. Although the economic forecast can never be fully certain, the market’s current tendency suggests a possibility…

-

Gold Price Change: XAU/USD Breaks 7 Week Streak Due to Elections and Upcoming Fed Announcements

Gold price has recorded a sudden snap after a seven-week rally, a noticeable event in the market ahead of crucial upcoming events: the U.S. Elections and Federal Reserve (Fed) announcements. After weeks of consistent growth, this break may seem surprising to some traders, but many experts had forecasted possible fluctuations amid significant political and economic…