Tag: Finance

-

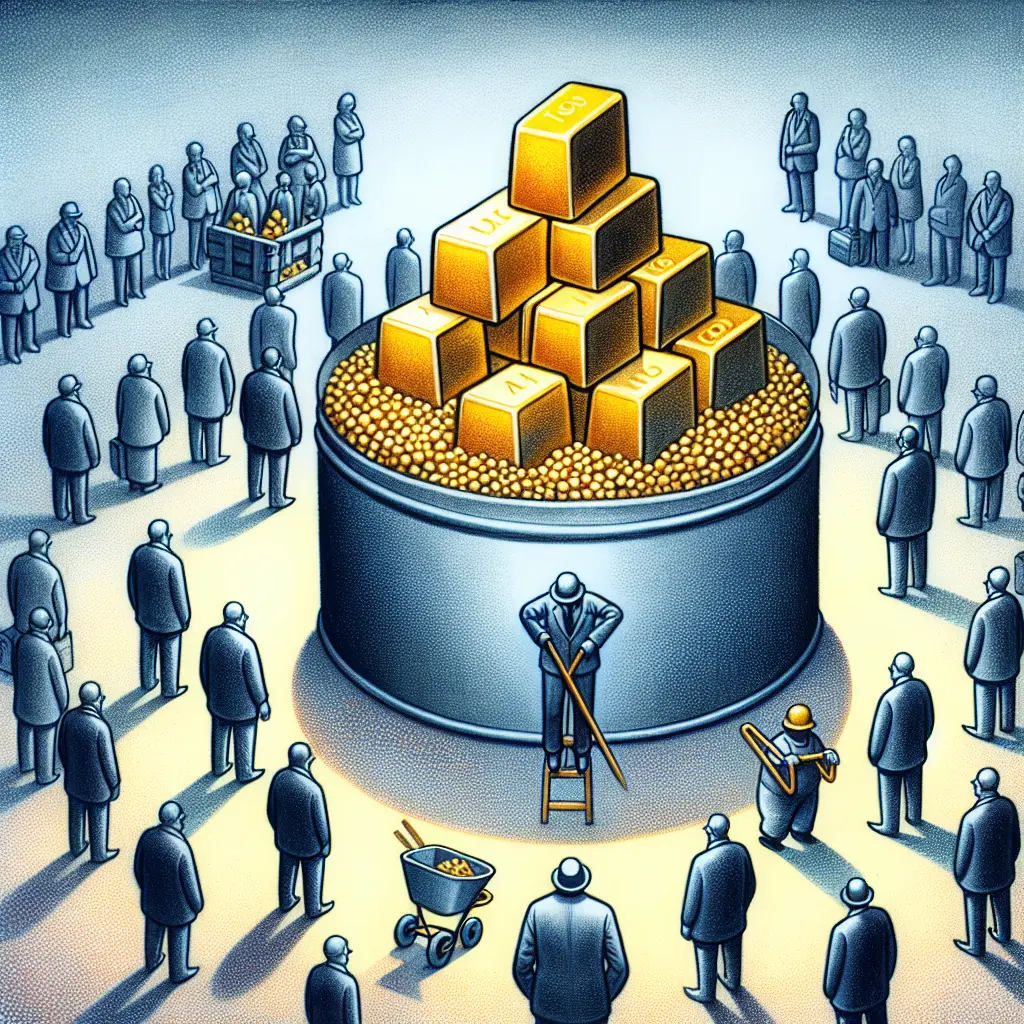

Historical High: Gold Achieves Highest Opening Price Ever on April 11, 2025

In an unprecedented turn of events, the price of gold today, Friday, April 11, 2025, has soared to achieve its highest opening price in history. Financial markets worldwide were both exhilarated and stunned by this unexpected leap. Gold is a favored investment, usually considered a safe haven during financial turbulence. This significant rise in the…

-

Gold Rate Falls Today: Experts’ Latest Gold Price Predictions

Traditionally seen as a safe haven in turbulent times, the price of gold has taken an unexpected dip today. Analysts are now adjusting their forecasts accordingly. The yellow metal’s price has taken a hit today, despite long-term projections heralding steady growth due to increased risk factors worldwide. This fall might seem alarming to the short-term…

-

The Most Expensive Cryptocurrency of 2025

In the world of finance, the landscape is continually evolving. Among the most striking developments in recent years is the emergence of cryptocurrencies, which are essentially virtual or digital currencies that use cryptography for security. In 2025, the crown for the most expensive cryptocurrency goes to Bitcoin, according to Statista. Despite the unpredictable sways in…

-

Rising Demand for Gold & Silver Amid Economic Uncertainty – FXEmpire

In the tumultuous world of global finance, investors are constantly seeking secure repositories to shield their funds from uncertainty. With escalating tariff tensions and looming bets on Federal Reserve interest rate cuts, safe-haven assets like gold and silver are enjoying boosted demand. Gold (XAUUSD) and silver prices have been steadily rising amidst this economic tension.…

-

Silver Price Outlook–Continuing Demand from Buyers | FXEmpire

According to recent trading patterns, the demand for silver continues to skyrocket. Investors are turning to safe-haven assets, with silver being a preferred choice. The Silver Price Outlook indicates a bullish trend, attracting more buyers into the market. Economic factors and geopolitical tensions also contribute to the rising demand for this precious metal. From a…

-

Maneuvering the Gold Market: Analysts’ Take on Historic Gold Rally

In an unforeseen turn of events, the world has seen a historic rally in gold prices, leading to a significant shakeup among major market analysts. Renowned market gurus have responded swiftly, overhauling their previous assessments and adjusting their gold price targets. This recent surge can be attributed to various global economic dynamics, coupled with the…

-

Silver Price Outlook – Massive Inflow of Buyers Reflects Confidence in Silver as a Stable Investment

In the financial world, silver continues to be a much sought-after commodity. The market trends have indicated a steady inflow of buyers, securing their assets by betting on this precious metal. Owing to worldwide economic uncertainties and the need for a stable investment, silver has come up as the perfect hedge against inflation. Massive buying…

-

Analysts Revamp Gold Price Targets Post Historic Rally

Following a historic rally in gold prices, major financial analysts have revised their predictions for the precious metal on TheStreet. The rally marks a significant shift in the market, with gold seeing an unprecedented surge in demand. As the market reacts to this change, experts are scrambling to reassess their forecasts and provide investors with…

-

Analysis of Gold and Silver Prices amid Trade Wars

As the trade war continues to intensify, significant shifts have been noted in the precious metals market. Notably, the forecast for gold prices has seen a considerable jump, reaffirming gold’s status as a safe haven amid economic turmoil. Investors have been turning to gold to hedge against the turbulence triggered by ongoing international trade disputes.…

-

Crypto and Recession: What can we expect?

Crypto During A Recession: Here’s What To Expect – Bankrate As the world economy approaches a recession, one of the biggest questions on everyone’s lips is ‘What will happen to cryptocurrencies?’ While some are wary of their volatility, others see them as a beacon of hope and a means of escaping the impending economic downturn.…

-

Forbes Top 10 Cryptocurrencies as of April 7, 2025

In the ever-evolving world of digital finance, cryptocurrencies continue to make bold strides. On April 7, 2025, Forbes published an article highlighting the top 10 cryptocurrencies leading the market. These digital currencies have exemplified notable growth and resiliency. Here are the top ten cryptocurrencies as of April 7, 2025.n 1. Bitcoin (BTC) continues to hold…

-

Latest Trade War Impact: Gold Prospects Brighten, Silver Forecasts Dwindle – 2025 Bullion Vault Predictions

The recent developments in the trade war have led to some significant fluctuations in the precious metals market. Industry expert forecasts project an increased price for gold while predicting a cut for silver by the year 2025.nnThe dynamically changing geopolitical environments, aggressive trade policies, and the looming economic uncertainty are heavily impacting the bullion market.…

-

Limited gold profit as U.S. CPI cools unexpectedly

In an unexpected turn of events, the U.S. Consumer Price Index (CPI) has cooled down more than anticipated. Consequently, the precious metal market has seen a limited profit-taking in gold prices. Experts speculate that this cooldown in inflation could be temporary. However, it provides a respite for investors and potentially an opportunity for those who…

-

Understanding Bitcoin, Tariffs and Stock Market Meltdown

With growing uncertainties surrounding the global financial sector, it’s crucial for investors and everyday citizens alike to understand some key concepts. This article focuses on four main areas: Bitcoin, tariffs, and the recent stock market turmoil. Bitcoin: In the wake of economic uncertainties, Bitcoin emerges as a potential safe haven asset. Its decentralized nature allows…

-

Trade Deficits, Tariffs, And Panic Influence Gold And Silver Price

In a tumultuous thread of events, the prices of Gold and Silver have been significantly affected by the global economic landscape. Increasing trade deficits, implementation of further tariffs, and heightening panic in markets have all played a part in this rollercoaster ride. The trade deficit, which indicates an outflow of domestic currency to foreign markets,…

-

Gold Price Today: Impact of Trump Tariffs on Global Markets

Today, the gold market has experienced a significant shift triggered by the newly imposed Trump tariffs. The global markets are feeling the impact, causing a heightened interest in the precious metal as a potentially stable investment during these uncertain times. The current tariffs imposed by Trump administration have severely disrupted trade relationships, leading to volatility…

-

Latest Update on Gold Prices Amidst Trump Tariffs Impact

As the world markets rocked by the unwavering Trump Tariffs, today’s gold prices hike as a result. For thousands of years, gold has been observed as a safe asset, often turning to it during economic or political uproars. As tariffs introduced by Trump administration continue to affect global trading norms, investors found solace in clinging…

-

Bitcoin Below $80,000: Resilience is Key

In yet another demonstration of the tumultuous nature of digital assets, todays financial headlines are dominated by Bitcoins value sinking below the $80,000 marker. It is in-keeping with a downward trend experienced across the stock market, implying a habitual pattern in the investment environment. However, analysts suggest that this dip should not be met with…

-

Bitcoin price drops amid global tariff market turmoil – Latest financial insights from Yahoo Finance

In an unexpected turn of events, the world’s leading cryptocurrency, Bitcoin, witnessed a significant drop in its value. This incident coincided with an ongoing tariff market rout, shaking investor confidence and causing some to speculate about the influence of global trade conflicts on cryptocurrency markets. The details of this market volatility underscore the tenacious link…

-

Gold Price Predictions: Up-to-date Gold Rate Projections From Leading Analysts

Gold Price Predictions The latest projections for gold rate have been released by a panel of top market analysts. Historically regarded as a safe haven asset, gold has been the subject of heightened interest in recent years, especially considering global market volatility. These projections were published in The Economic Times, and they offer crucial insights…

-

The Existential Threat: Wall Street’s Unexpected Brace For Bitcoin And Crypto Price Game-Changer

In an unexpected turn of events, Wall Street suddenly braces for a Bitcoin and crypto price game-changer, sending ripples throughout the financial markets. Rapid strides in decentralized finance, a proliferation of digital currencies, and rampant speculation have made Bitcoin, along with other cryptocurrencies, a facet of the contemporary economic narrative. Indeed, these digital currencies, detached…

-

2025 Precious Metals Price Surge and the Uncertain Future of Central Banks

In the financial sphere, 2025 has marked a consequential shift in the dynamics of global economics. An unprecedented surge in gold and silver prices has sparked a global debate raising questions on the very foundation of monetary systems â the Central Banks. In the last decade, precious metals have shown remarkable resilience. Despite the economic…

-

Silver Price Outlook: Tariffs Impact Causes Unprecedented Dip

In a shocking turn of events on the precious metals market, silver prices have suffered a massive blow following the introduction of new tariffs. nn The economic downturn triggered by the increase in the international tariff situation has impacted the silver market stacks considerably causing unprecedented price drops. As investors and the global industry grapple…

-

Gold Price Suffers From Profit-Taking and Weak Long Liquidation – KITCO, 4th April 2025

The world of gold trading saw a downturn as prices fell due to an increase in profit-taking and weak long liquidation, as reported by KITCO. The spot gold market was witness to a quiet trading session recently as both professional and novice traders opted to take profits instead of maintaining their long positions. This resulted…

-

HSBC Forecasts Rise in Gold Prices Amidst Global Geopolitical Tensions

In a recent announcement, HSBC has revised its gold price forecasts with an upward trend, primarily due to brewing geopolitical tensions. The global banking giant is relying heavily on the safe-haven status of gold since these geopolitical uncertainties stimulate risk-off sentiment among investors. It’s important to note that gold prices often skyrocket when political or…

-

Unanticipated Plunge in Silver Prices – In-depth Analysis and Forecast

In a surprising turn of events, the International Silver Market observed another plunge on Friday, continuing its streak of unprecedented depreciation. Analysts from all sectors were taken aback by this fluctuation, attributing it to various external factors such as the global economic condition and policy changes. The steep fall of silver prices has caused a…

-

Gold Price Drops by 2.8% Following Hawkish Stance on Tariffs and Inflation by Powell

The gold market has been rocked by a surprising 2.8% crash in prices, following Federal Reserve chief Jerome Powell’s hawkish turn on tariffs and inflation – a shift that has unsettled various financial markets. Powell’s hawkish stance is seen as a strong indication of potentially tightening economic policies that are typically negative for non-yielding assets…

-

Gold Value Falls as Stock Market Takes Hit – Understanding the Financial Market Shifts

With a tumultuous turn in the stock market, investors are shifting their positions, causing a notable retreat in the value of gold. The precious metal, often seen as a safe haven in times of market distress, has seen a dip due to frantic efforts by investors to cover their losses. This is an unusual phenomenon,…

-

Silver Price Outlook – Significant Changes After Tariffs – FXEmpire

In a major turn of events this week, silver prices took a severe plummet after tariffs were announced. The shiny precious metal, often considered a reliable investment, proved to be not so resilient in the face of global economic policies. Overnight, investors saw their holdings decrease significantly, leading to unrest in the financial world.nnInvestors across…

-

Gold & Silver Price Drops as Trump Exempts ‘Bullion’ from US Trade Tariffs

Gold Sinks $100, Silver -7% as Trump Exempts ‘Bullion’ from US Trade Tariffs – BullionVault In an unprecedented move by former President Donald Trump, ‘Bullion’ precious metals are now exempt from U.S. trade tariffs. This decision prompted a notable drop in the value of gold by $100 and a 7% slump in silver prices. Interest…